Sam Bankman Fried The Rise and Fall of a Crypto Giant

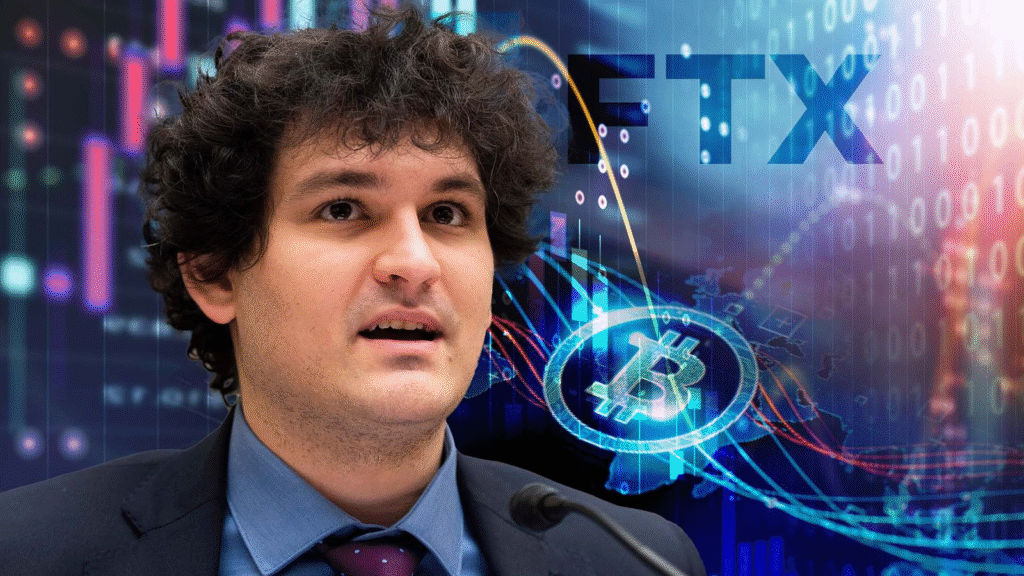

Sam Bankman Fried is a name that almost everyone in the crypto world knows. Sam Bankman Fried once became one of the youngest billionaires and was often seen as a smart and trusted voice in digital money. He built a huge empire through his company FTX, which many people thought was safe and strong. For a time, he was seen as a genius who could change how the world used crypto. But later, shocking news came out, and everything people believed about him started to fall apart. His journey shows how fast fame and success can come, and how quickly it can all disappear when mistakes happen.

Sam Bankman Fried’s story is not just about one man but about trust, money, and choices that affect millions of people. When FTX collapsed, it left thousands of investors in deep trouble. Many people lost their savings, and the whole crypto industry shook with fear. Questions were raised about how one person could control so much money and make risky moves without people noticing earlier. The rise and fall of Sam Bankman Fried is a lesson for everyone—investors, businesses, and everyday people—that even the biggest names can fail. His case is also making governments think harder about rules for crypto so people can be more protected in the future.

The Early Life and Big Dreams of Sam Bankman Fried

Sam Bankman Fried grew up in a family that valued education and critical thinking. His parents were both law professors, so he learned about responsibility and decision-making from a young age. However, he was more interested in solving problems with numbers than becoming a lawyer. At MIT, he focused on science but also started exploring trading and finance, which sparked his interest in building something bigger.

After working at a trading firm, Sam realized that crypto had massive potential. It was new, risky, and exciting. He believed that crypto trading could be more efficient and transparent. This belief inspired him to start his own company. His goal wasn’t just to become rich but to change how people around the world think about money and technology. His early dreams were bold, and for a while, it looked like he was on the path to achieving them.

How Sam Bankman Fried Built His Crypto Empire with FTX

In 2019, Sam Bankman Fried launched FTX, a crypto exchange that quickly grew into one of the most trusted platforms in the world. What made FTX different was its user-friendly design, advanced features, and strong focus on safety. Traders loved it because it allowed them to trade crypto easily and offered tools that even professionals used. Within just two years, FTX became a global leader, attracting investors, celebrities, and even sports teams.

Sam was often in the news for his smart business moves and generous donations. He promised to give away much of his wealth to charities and causes that could help humanity. This made him look like a hero in the crypto world. He became a billionaire before turning 30, and FTX was valued at over $30 billion. Many people believed that Sam Bankman Fried was building the future of money.

The Turning Point: What Went Wrong for Sam Bankman Fried?

Everything seemed perfect for Sam Bankman Fried, but behind the scenes, things were falling apart. FTX’s success was built on trust, and that trust started to break in 2022. Reports came out that Sam was using customer money from FTX to fund risky investments through another company he owned, called Alameda Research. This was a serious problem because it meant people’s funds were not safe.

When investors learned about this, panic spread. People rushed to withdraw their money, but FTX did not have enough funds to pay them back. In just a few days, the company collapsed. Billions of dollars were lost, and thousands of users were left with nothing. Sam Bankman Fried’s reputation changed overnight—from a crypto hero to a man accused of one of the biggest financial scandals in history.

The Collapse of FTX and Its Impact on Millions

The fall of FTX shook the entire crypto industry. It was not just another company—it was a trusted platform used by millions. Its collapse caused the price of many cryptocurrencies to drop, and confidence in the industry was badly damaged. Some experts compared it to the 2008 financial crisis, but in the crypto world.

Many small investors lost their life savings, and some companies that worked with FTX also went bankrupt. Governments around the world started looking more closely at crypto companies and discussing new rules to protect people. The downfall of FTX was not just about one man’s mistake; it exposed how unregulated and risky the crypto industry still is.

Legal Battles and Court Trials Faced by Sam Bankman Fried

After FTX collapsed, Sam Bankman Fried was arrested and faced multiple charges, including fraud, money laundering, and misusing customer funds. Authorities claimed he lied to investors and used their money for personal gain. He has spent months in court, defending himself and trying to explain what happened.

The trial has become one of the most closely watched in financial history. It shows how even the biggest names can face justice if they break the law. The case is still ongoing in many ways, but one thing is clear: Sam Bankman Fried’s future will never be the same again.

Lessons to Learn from the Story of Sam Bankman Fried

The story of Sam Bankman Fried is full of lessons for everyone. For investors, it teaches the importance of doing proper research before trusting any platform. For businesses, it shows how vital honesty, transparency, and responsibility are when handling other people’s money. And for the crypto industry, it highlights the urgent need for better rules and protections.

Sam’s story also reminds us that success can vanish quickly if decisions are not made wisely. Even the smartest people can make mistakes that affect millions. Trust is hard to build but easy to lose—and once it’s gone, it’s almost impossible to get back.

How Sam Bankman Fried Changed the Way People Look at Crypto

Even though his story ended badly, Sam Bankman Fried changed the crypto industry forever. He showed the world how powerful and fast-growing digital finance could be. He also showed the dangers of greed and lack of control in an industry with few rules.

After the FTX collapse, more people began asking tough questions about crypto platforms. Governments started writing new laws, and investors became more careful. In this way, Sam’s mistakes might help build a safer future for crypto in the long run.

Conclusion

Sam Bankman Fried’s journey is a story of dreams, success, and downfall. He started as a smart and hopeful young man who wanted to change the world of money. For a while, he did. But mistakes, greed, and bad decisions led to one of the biggest financial disasters in crypto history. His story is a reminder that trust is the most valuable currency of all—and once lost, it’s hard to earn back.

FAQs

Q1: Who is Sam Bankman Fried?

Sam Bankman Fried is the founder of FTX, a major cryptocurrency exchange that collapsed in 2022 due to financial misconduct.

Q2: What happened to FTX?

FTX collapsed after it was revealed that customer funds were misused, leading to a massive withdrawal rush and bankruptcy.

Q3: Is Sam Bankman Fried in jail?

He has been arrested and faces several criminal charges. His legal case is still ongoing.

Q4: How much money was lost in the FTX collapse?

Billions of dollars were lost, affecting millions of users and companies connected to the platform.

Q5: What lessons can we learn from his story?

We learn the importance of trust, transparency, and careful research before investing in any financial platform.